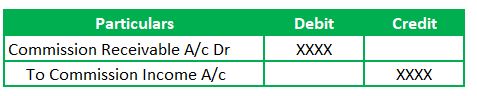

Journalise Acquired Commission

The most notable danger entails human error, resulting in inaccurate fee calculations. Errors in calculation often end in financial losses and create mistrust among the sales staff. This type of transaction happens when the company didn’t make any report relating to the accounts receivable. Outstanding bills are those bills which might be associated to the same accounting interval in which accounts are being made however aren’t yet paid.

Question 1: Gallery Accounting For Selling Artwork

The above entry accounts for the Cash obtained towards the Accounts Receivable. Agents https://www.intuit-payroll.org/ will receive cash/bank and let go of the asset account. In different words, the Accounts receivable asset replaces the Cash GL.

The accounting remedy of commission obtained involves recognizing it as earnings in the books of accounts when it is earned, no matter when the payment is received. It is handled as a revenue item and is recorded by crediting the Commission Revenue Account and debiting either the Cash/Bank Account (if received) or Accounts Receivable (if due). This ensures the monetary statements accurately replicate all income earned in the course of the accounting interval, supporting proper monetary evaluation and reporting. This earnings is recorded in the commission earnings account inside the bookkeeping data of a business. On the revenue assertion, also recognized as the profit and loss report, fee earnings is part of the entire revenue.

Greatest Practices For Commission Accounting

This timing affects money flow and should align with firm coverage. For example, if a salesperson sells a product price $10,000 with a 5% fee, the commission earned is $500. Understanding these percentages helps anticipate earnings and plan sales methods accordingly.

The company has to document the revenue base on the accrued basics. The recording will depend upon the prevalence rather than money collection. So the company has to document receivables when the service is supplied to the shopper. Fee expenses A/c is a nominal account, and Salary Payable is a Private Account. In this example, marketing agents obtained a Commission in opposition to making real property plot gross sales. The accounting remedy of the Fee Acquired Journal Entry is similar to another revenue Journal Entry.

This accurate recording is crucial for reflecting the business’s true monetary efficiency and making knowledgeable monetary choices. Commission is the quantity that the corporate spends on somebody to finish the sale of products or services. Company pays the fee fee to the agency, different company or even their own staffs after they successfully make sale. On 21 August 2023, a Fee amounting to ₹8,100 was received by way of cheque. Such bills that are involved with the next financial year, but have been paid in the current year are called prepaid bills. In this case, only a single entry is handed as a result of curiosity is instantly obtained.

When the fee fee is obtained into your bank account you’ll enter the fee to the Fee Income account. How to enter fee income within the bookkeeping accounting information of a small business. Actual Estate Property Property brokers earn commission income on the properties they promote. The property proprietor pays a fee to the property agent when the property is offered. The owner of a product can additionally be referred to as an employer in the occasion that they hire a sales representative as an employee and pays them commission revenue on high of a wage.

Each affiliate gets a fee primarily based on the number of books they bought. So, the extra books an affiliate can promote, the more commission they’ll earn over the other affiliates. The word fee has several meanings, but in bookkeeping accounting, fee means a charge that an individual or business receives or pays out when a business transaction is completed. To stop fraud and error, it’s essential to implement segregation of duties within the accounting department. By delineating responsibilities across a number of individuals or teams, companies mitigate the risk of unauthorized entry to monetary records and enhance inside controls. Effective fee accounting strengthens business operations.

For correct monetary reporting, it is important to match fee expenses with the gross sales revenues they assist generate in the same interval. The Commission Received Journal Entry with Instance helps illustrate the means to record income earned by way of commission in the books of accounts. This entry displays the rise in earnings and both an increase in cash/bank steadiness (if received) or receivables (if due). Understanding this journal entry with a sensible instance ensures readability in recording and correct representation in ultimate accounts. Let’s now look at detailed examples with proper commission-received journal entries.

- Closing balances of all of the accounts are carried ahead to the new yr as opening balances.

- It is handled as a income item and is recorded by crediting the Fee Revenue Account and debiting either the Cash/Bank Account (if received) or Accounts Receivable (if due).

- Any amount spent to have the ability to purchase or promote items or providers that generates income in the business known as bills.

- Withdrawal of any amount in cash or kind from the enterprise for personal use by the proprietor is termed as Drawings.

- Businesses should ensure compliance by documenting fee payments appropriately.

Journal E-book is maintained to have prime data for small firms. After preparing the journal guide, the transactions are then posted to Ledger. Write “Sales commissions expense” and the quantity of the expense as a line merchandise within the working expenses section of your earnings assertion at the finish of the accounting period.

The amount invested within the enterprise whether in the means of money or type by the proprietor or proprietor of the enterprise is called capital. The capital account shall be credited, and the money or belongings introduced in will be debited. Common audits of obtained commission journal entries are imperative to validate the accuracy and integrity of monetary information. Whether Or Not performed internally or by exterior auditors, these evaluations provide an additional layer of assurance and identify any discrepancies or irregularities that require remediation. Moral issues, corresponding to clear communication of fee structures and honest fee allocation, are very important for fostering a positive gross sales tradition.